Take-profit order, often used in trading and investing, is a type of order that allows a trader or investor to set a specific price at which to close a position and realize a profit. This order is placed by traders to lock in their desired profit level and avoid potential losses. When the market reaches the predetermined price, the take-profit order is executed, closing the position and securing the profit.

This type of order can be particularly useful in volatile markets where price fluctuations are common. By setting a specific profit target, traders can remove the temptation to hold onto a winning position for too long, potentially risking the profit evaporating.

When using take-profit orders, it is important to be aware of any fees or commissions associated with executing the order. Some brokers may charge additional fees for executing take-profit orders, which can eat into the overall profitability of the trade. Traders should consider these costs when determining their profit targets and ensure that the potential profit outweighs any fees or commissions.

Take-profit orders are commonly used in various financial markets, including stocks, foreign exchange (forex), and cryptocurrencies. They are especially popular among day traders who aim to capitalize on short-term price movements.

[Video]: What is a Take Profit Order?

What is the Example of a Take Profit Order?

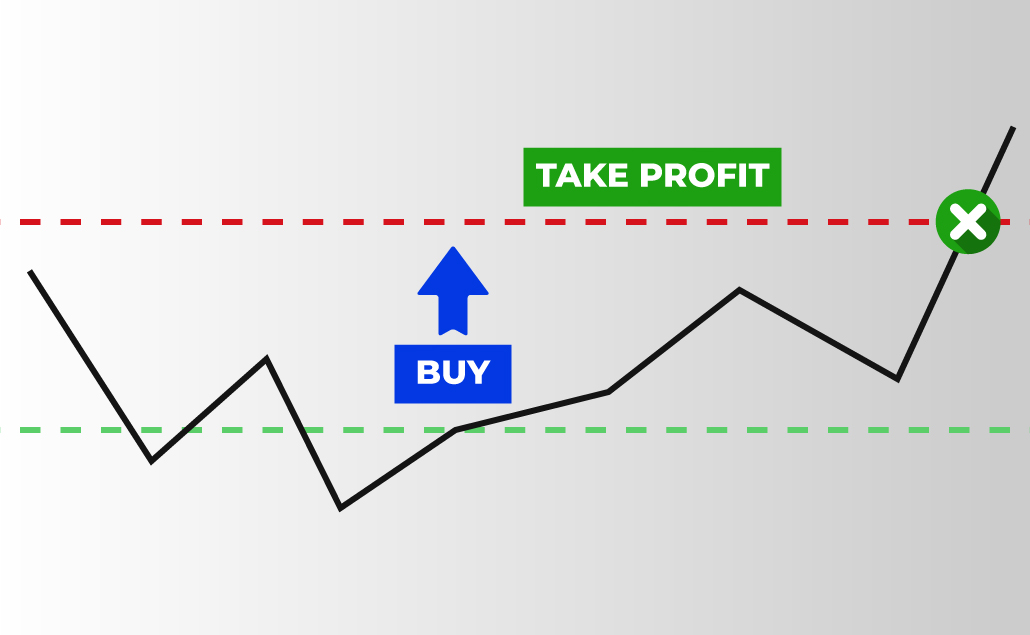

To further understand how a take-profit order works, let’s consider a trader who buys 100 shares of ABC stock at $50 per share. The trader sets a take-profit order at $60. This means that if the price of the stock reaches $60, the trader’s position will be automatically closed, ensuring a profit of $10 per share. Take-profit orders are commonly used to secure gains and manage risk in trading and are particularly useful when you are unable to constantly monitor the market or when you want to avoid making impulsive decisions based on short-term fluctuations in price.

Related Topics | Keep learning more with Eurotrader

Check out our resources below for more information on the Stop-Loss order and much more on the basics of trading!

How Does a Take Profit Order Work?

Take-profit orders are typically set above the current market price for long positions and below the market price for short positions. Traders often use technical analysis and market research to determine the appropriate price level for their take-profit orders. By utilizing take-profit orders, traders can implement a disciplined approach to their trading strategy, ensuring that they capture profits when the market moves in their favor.

Take-profit orders are not foolproof and may not always guarantee the desired profit level. In fast-moving markets, prices can quickly change, and it is possible for the market to surpass the specified take-profit level of the order. Traders should regularly review and adjust their take-profit orders to adapt to changing market conditions.

What are the Benefits of a Take Profit?

Take-profit orders, allowing traders to set the specific price level at which they want to exit a position. This flexibility allows for strategic decision-making based on market conditions and individual trading strategies.

One key advantage of using a take-profit order is to remove the element of human emotion from trading. Emotions such as fear and greed can often lead to impulsive and irrational trading decisions. By setting a predetermined target price, traders can stick to their original plan without being swayed by temporary market fluctuations.

Another benefit of using take-profit orders is that they allow traders to automate their trading strategies. Instead of constantly monitoring the market and manually executing trades, traders can set up take-profit orders to automatically close positions when certain price levels are reached. This frees up valuable time and reduces the risk of missing out on profitable opportunities.

In addition to locking in profits, take-profit orders can also be used to manage risk. Traders can set stop-loss orders, which are opposite to take-profit orders, to automatically close positions at a specified price in order to limit potential losses. By combining take-profit orders with stop-loss orders, traders can create a well-rounded risk management strategy.

Related Articles

Disclaimer

Eurotrader doesn’t represent that the material provided here is accurate, current, or complete, and therefore shouldn’t be relied upon as such. The information provided here, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product, or instrument; or to participate in any particular trading strategy. We advise any readers of this content to seek their advice.