CFDs let traders speculate on price movements without owning the underlying asset.

There are many trading strategies that have enjoyed a significant amount of attention over the past few years. However, contracts for difference (CFDs) still enjoy the lion’s share of popularity.

Why is this the case? What are some benefits of CFD trading that continually attract novices and professionals alike? To answer these questions, we should first take a quick look at the fundamental principles of CFD investing. We can then delve into the finer points before drawing an objective conclusion.

The main principle of CFD trading is associated with price speculation. Investors will predict the future value of an underlying asset. Note that it is possible to enter into a long (buying) position, or a short (selling) stance depending on which direction the price is slated to move within a given time frame. Having said this, the trader will never physically own the asset; enabling those with a relatively limited amount of capital to become involved.

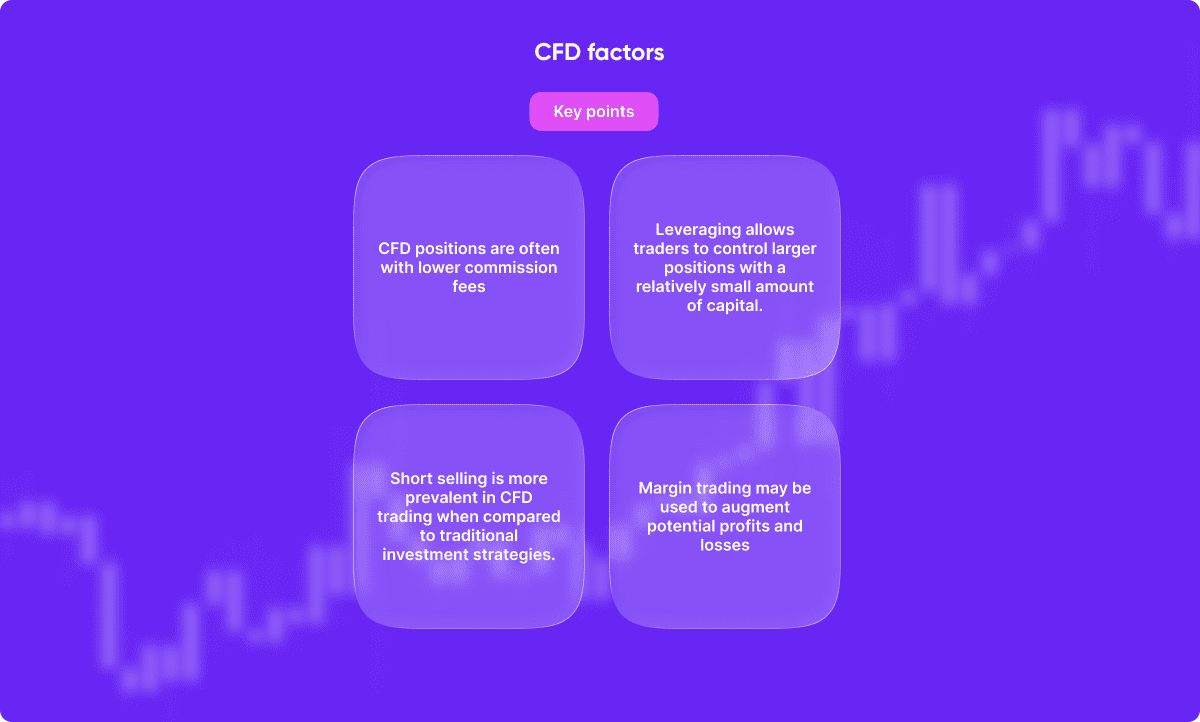

So, what are some of the ways in which CFD positions differ from other forms of investing? We have already mentioned the lack of real-world ownership. However, there are several other factors to appreciate:

Therefore, contracts for difference can represent a powerful tool within any comprehensive trading strategy. CFDs may likewise be used to complement other techniques such as swing trading, price action trading, and long-term trading.

Investors have always been drawn to a kaleidoscope of advantages; especially if they choose to employ the talents of a seasoned CFD trading broker. It pays to highlight some of the points that were briefly mentioned within the previous sections of this article.

Many will argue that leveraged positions are the most pronounced benefits of CFD trading. Individuals can stake a relatively small amount of capital to gain a proportionally large level of exposure. Assuming that the price moves are predicted correctly, profits can be dramatically enhanced.

Unlike some other types of investments, traders can open long and short positions. Thus, it is possible to turn a profit even if the value of an asset happens to fall. This is also one of the reasons why CFD trading is exceedingly popular during bearish market conditions.

Variety is the spice of life, and CFD investing clearly illustrates this maxim. Some assets that can be traded as CFDs include:

Therefore, investors can use these vehicles to develop a balanced portfolio.

The asset in question is never physically owned by the trader. This is yet another one of the most common CFD trading pros. A lack of ownership signifies that it is possible to enter into a trade that might otherwise be prohibitively expensive.

CFD trading allows users to bypass traditional brokers; a scenario known as direct market access (DMA). This reduces hefty fees, provides greater end-user control, and results in faster executions. In other words, investors have much more control over their positions.

Similar to other assets such as Forex pairs and cryptocurrencies, traders can access the CFD marketplace on a 24/7 basis. This is ideal for those who need to accommodate a busy schedule, or simply wish to avoid times of the day associated with high network congestion (particularly when spot trading).

It is now apparent to see why investors are perpetually drawn to these positions. However, what is CFD trading in terms of the potential risks? The team at Eurotrader always wants to provide our readers with a fair and balanced perspective, so it is wise to examine some possible pitfalls.

Although margin trading is an extremely attractive prospect, note that losses can sometimes far outstrip the initial investment. Traders must be careful to limit their exposure during times of market uncertainty, or volatile price swings.

Some CFD trades may be subject to overnight fees. These could impact profits, so investors should be aware of their obligations before opening a position.

There may be times when another party fails to fulfill its initial obligations (known as a counterparty risk). This is why it is always essential to partner with a reputable broker with a solid track record.

The fact that a CFD is not owned by the trader can lead to large-scale speculation; possibly resulting in unexpected price movements. Some also feel that physically holding an investment provides a greater level of transparency.

Establishing a CFD trade is a relatively simple process, and it involves the following steps:

There are likewise several CFD trading strategies to consider. Notwithstanding long and short positions, investors can employ other methods. These include technical analyses, breakout trades (monitoring support and resistance levels), and hedging. Note that additional information can be obtained by contacting a specialist at Eurotrader.

Another important portion of any trading strategy involves mitigating the associated risks. Investors should only open a position if they are relatively confident in the predicted outcome, and they should never practice margin trading with funds they cannot afford to lose. Furthermore, it is wise to invest no more than 2% of one’s total liquidity at given time. Losses can (and will) occasionally occur. The main point is not to eliminate these risks, but to limit their overall impact.

CFDs could represent powerful vehicles for those who are already familiar with a specific asset class, and for anyone comfortable with certain levels of risk (especially when entering into a leveraged trade). Having said this, CFD investments might not be the best options during the following scenarios:

Similar to any other type of investment, CFD trades should occur once you have gained the knowledge and confidence needed to make sound decisions.

Discover the latest updates, insights, and trading opportunities with Eurotrader — click here to explore further.

The most recent advancement associated with CFD trading involves the use of artificial intelligence (AI). These clever “bots” are capable of executing automated algorithms intended to more accurately predict price movements. Furthermore, they are sometimes employed to expedite the trading process. It should still be mentioned that AI is in its infancy, and some have questioned the overall profitability of this technique. It will be interesting to see what the future may have in store.

Let us conclude by addressing a handful of common questions.

To recap, here are the primary benefits of CFD trading:

Similar to any other type of investment, profits can be obtained through CFD trading. These will depend on factors such as accurate price predictions, the asset in question, the length of the contract, and underlying market conditions.

Professional traders will often employ CFD positions in synergy with other strategies. This will help to create a balanced portfolio, especially for those who want to increase their short-term liquidity.

Do you wish to learn more about the benefits of CFD trading? Would you like to become involved with this unique approach? If so, take a few moments to register with Eurotrader. We will be more than happy to answer any additional questions that you may have.

Start your trading journey with Eurotrader today — register and trade with confidence.