Artificial intelligence (AI) continues to transform the world as we know it. Whether referring to software packages such as ChatGPT, predictive algorithms, or financial investments, it seems as if AI has become a ubiquitous element of our daily lives. To put these observations into perspective, the estimated value of the global AI marketplace (as of 2023) was approximately $189 billion dollars. Analysts predict that this very same market cap could quadruple by 2033; resulting in a sector worth more than $4.8 trillion dollars.

This is why it stands to reason that astute traders are keen to leverage the latest opportunities. While this is a rather broad topic, we can still distil the more technical aspects of artificial intelligence and translate these features into the investment domain.

The purpose of this white paper is to highlight some of the factors that may affect the value of AI stocks, to identify the predominant trends throughout 2025, and to review some of the challenges that this burgeoning sector may face in the coming years. Before delving into a handful of the best AI stocks to buy in 2025, it pays to look at the current state of affairs.

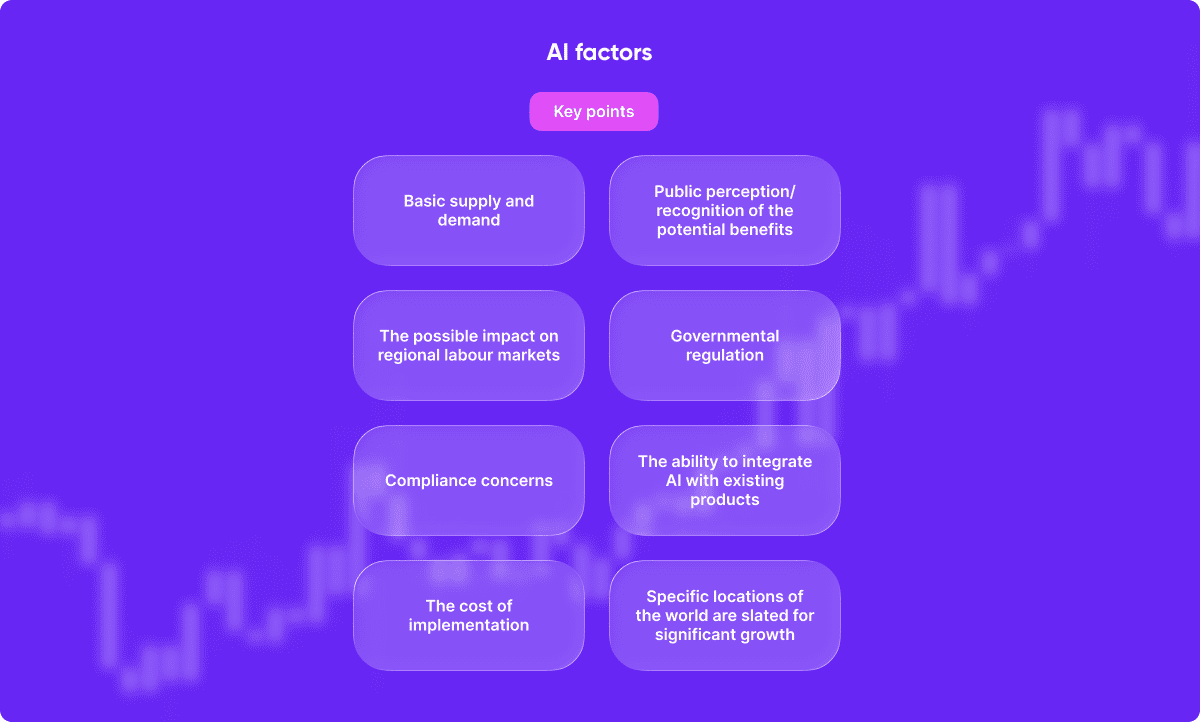

Similar to any underlying asset, it is always prudent to examine the various factors that may influence the price of AI stocks in the near future. There are several macroeconomic metrics that could exert a notable influence. A handful of fundamentals include:

While it is apparent that the realm of AI is quite dynamic at the moment, there are still some notable trends that have come to dominate the 2025 marketplace.

One interesting development is associated with the growing role of AI in relation to financial services. Two examples include the IndexGPT platform released by JPMorgan Chase, and the rise of quantitative hedge funds (comprising more than 29% of all hedge funds throughout the United States in 2025).

Another trend involves the presence of generative AI (much more advanced than predictive artificial intelligence models). These algorithms are capable of mimicking human speech, and their highly intuitive nature is set to transform the entire user experience in the near future. Some other movements worth mentioning before moving on include:

Although it can be challenging to keep abreast of these factors, the fact of the matter is that the fluid nature of the sector likewise provides a host of opportunities for those who appreciate the best AI stocks of 2025, and what each asset has to offer.

To efficiently identify the best AI stocks to buy now, it is first logical to analyse the various asset classes. Similar to other financial holdings, each class is associated with its own set of risks, and rewards. Although it may be argued that the categories outlined below could be distilled into even more sub-classes, we will highlight the primary sectors for the sake of brevity. It will then be much easier for readers to determine which industries are the most relevant for their investing requirements.

We can think of core infrastructure as the veritable “building blocks” of contemporary AI technology. Although the majority of AI systems are located in the cloud, we still need to remember that they are all based on physical hardware (to a greater or lesser extent). From microchips and GPUs to complicated systems such as non-volatile memory storage units, and real-world data centres, the fact of the matter is that artificial intelligence would have never been able to progress as far as it has without the presence of reliable infrastructure.

The term “hyperscaler” is simply another way of describing any type of technology capable of building (or “scaling up”) additional artificial intelligence infrastructure. The end products can range from relatively small office software stacks to large language models (such as Google’s Big Sleep cybersecurity protocol). Some experts predict that AI hyperscaling software could represent one of the most important paradigm shifts within this sector over the coming years.

This is perhaps the most practical sector of artificial intelligence (at least at the moment). It also represents one that readers are likely to at least vaguely recognise. The types of AI software will obviously depend on the intended application, and some well-known examples currently include:

The analytical side of artificial intelligence has also enjoyed an impressive amount of popularity. Tableau (Salesforce) and Power BI (Microsoft) are two examples that some readers may recognise; especially those who happen to be employed within the CRM sector.

Certain other sectors related to artificial intelligence might not be as apparent. Some of these could also provide “behind-the-scenes” solutions. For instance companies associated with maintaining AI-driven data centres will have a direct stake in the future of the industry. There are likewise many small-cap firms that could very well represent the next “golden ticket” in terms of innovation. Note that this final category will also be more speculative in nature; particularly when discussing the role that AI startups have to play.

We now come to the crux of this article. What are the best AI stocks to buy now, and what qualities make these firms unique? We will quickly peruse seven of the hottest tickets to better appreciate your opportunities.

Many analysts feel that NVIDIA is the best large-cap AI stock to add to one’s portfolio. This is partially due to a track record that currently spans no fewer than 33 years. In other words, NVIDIA has always been a major player throughout the digital community.

This company has likewise invested heavily in artificial intelligence; specifically in the GPU chips that the majority of AI systems utilise when performing day-to-day operations. Furthermore, NVIDIA chips currently enjoy more than 90 per cent of the entire market share for AI microprocessors. This is one of the reasons why the value of their data centres has increased by more than nine times in just over two years. NVIDIA is an excellent long-term opportunity; ideal for low-risk investment strategies.

Any firm associated with Google is bound to enjoy a significant amount of attention, and Alphabet is certainly no different in this case. Alphabet is essentially involved with AI-powered online searches. While it is not the only software platform to tackle this sector, we need to remember the sheer size of Google.

Google Chrome is currently used by 65 per cent of all laptop-based browsers, while 70 per cent of smartphones rely on the Android operating system. This signifies that Alphabet should continue to be integrated with existing products. Other companies are not able to enjoy such a pronounced global market share. Notably, some users have begun to claim that this system offers more advantages than ChatGPT; a clear indication that Google is on the right track.

Although this next company does not enjoy the clout associated with the options previously mentioned, some feel that SoundHound AI could be one of the best stocks to buy in 2025. There are three main reasons behind this observation:

SoundHound has also been referred to as the “wonder stock” on several occasions due to amenable entry-level price points. In other words, it could be an excellent opportunity for small-cap investors.

Taiwan Semiconductor Manufacturing is a lesser-known company, and yet, it has recently been making waves behind closed doors. The main reason why investors are taking notice involves the the real-world applications of TSM. This company is currently the leading supplier of microchips to major firms including Apple, Broadcom, and Advanced Micro Devices. The proprietary manufacturing processes that TSM has developed also helps to reduce overall production costs; making their products extremely cost-effective options.

Readers may not be familiar with Meta Platforms, as the majority of its operations occur “behind the scenes”. However, this is also one of the best AI stocks to invest in 2025. Why have traders taken notice of Meta? The reason is surprisingly simple. Meta is an extremely powerful digital advertising platform, and it has begun to incorporate artificial intelligence into its existing software.

Marketers are likewise attracted to Meta’s use of AI, as they can now strategically target specific demographics while spending less on the advertising campaigns themselves. Let’s also remember that Meta is the company behind WhatsApp; one of the most well-known messaging services in the world. Assuming that their use of artificial intelligence continues to increase, there is every reason to assume that the stock price of Meta will rise well into the future.

We have already seen that Taiwan Semiconductor Manufacturing is leading the way when it comes to the production of microchips. However, their success would not have been possible without the equipment required to make the chips themselves. This is when another firm known as ASML comes into play.

ASML provides industry-specific hardware that is vital to organisations such as TSM. One example involves a process known as extreme ultraviolet lithography; a technique used to produce the latest generation of microchips.

We are once again referring to supply and demand in this case. As long as the demand for next-generation chips continues to increase, we can assume that the price of ASML stock will concurrently rise.

Amazon (AMZN) is yet another company that has learned to embrace the presence of artificial intelligence. Amazon Web Services (AWS) is one example of how this technology is being leveraged. AWS specialises in fields such as Natural Language Processing (NLP) and machine learning. While these might seem to be nebulous terms, they have come to represent vital components within many online marketing strategies.

While the growth of AWS has been robust over the past few years, it is just as relevant to remember that Amazon is one of the largest online retailers in existence. This makes it possible for them to invest considerable amounts of capital into future AI development.

Broadcom is a final recommendation, and for good reason. This company manufactures semiconductors, and a host of related infrastructure. They are also firmly entrenched within other sectors such as broadband wireless connectivity, enterprise-level software, and cloud storage solutions. Although mainly focused in the United States, we need to remember that this is also one of the regions that has begun to embrace the large-scale adoption of artificial intelligence. it stands to reason that Broadcom should directly benefit as a result.

The technical indicators associated with Broadcom are likewise quite strong. They expect to enjoy a revenue of $14 billion dollars by the end of Q4; clearly signalling that they are remaining ahead of the IT curve.

While the best AI stocks to invest in in 2025 are certainly impressive when discussing the upside potential, we need to remember that this sector also presents a fair number of challenges. Some prominent issues will be outlined immediately below.

One issue investors may face is the speculative nature of some AI ventures. Of course, this is just as relevant when discussing any burgeoning industry that is breaking new ground. The uncertainty surrounding Bitcoin after its official introduction in 2008 is a prime example. Similar to any type of innovative venture, a fair amount of volatility may exist with some small-cap AI stocks. This should be taken into account, and a fair amount of research could likewise be warranted. Valuations can change, and there may also be instances when the price of a specific asset will be subject to a significant amount of fluctuation.

Regulations will also come into play. Governments have already begun to scrutinise AI technologies based on concerns such as privacy, transparency, and ethics. Should a certain company violate policies that have yet to be clearly defined, it could face a significant public backlash. This would obviously affect its underlying value.

Politics will undoubtedly exert an influence; particularly when discussing the regulatory concerns mentioned above. Should compliance protocols vary between regions, AI-based firms might choose to relocate their base of operations. The availability (and cost) of the software could also be impacted.

When combined with macroeconomic uncertainties (including productivity, a rapidly evolving labour market, and even the raw materials required for supporting hardware), it becomes clear that investors will need to constantly monitor various markets, news outlets, and economic reports.

Assuming that the demand for AI outstrips the supply of available systems, the entire industry could be faced with a considerable amount of competition. This will naturally cause some startup firms to struggle, and larger providers may also be forced to change their tactics. This may lead to notable levels of volatility; yet another cause for sudden price swings. However, competition is also associated with increased liquidity. This would be likely to produce opportunities for short-term trading strategies.

Our compendium of the best AI stocks for 2025 was not drawn from a proverbial hat. On the contrary, it was based on quantifiable data. This information was also compiled by examining a handful of medium-term market forecasts. So, what do the experts have to say about the potential future of artificial intelligence?

Most analysts feel that AI will continue to represent one of the fastest-growing market sectors. Some have predicted a compounded annual growth rate (CAGR) of up to 36 per cent between 2025 and 2030. While this is a general observation, it still bodes well for the sector as a whole.

Furthermore, it is thought that certain regions of the world will spearhead the large-scale introduction of artificial intelligence due to their existing strengths in the IT sector. The United States and China represent two possible examples of things to come.

We should also take into account companies that are currently leading the way in terms of overall AI development. Amazon, Facebook, Google, and Apple immediately come to mind. Investments in these blue-chip firms (even if not specifically associated with AI advancements) could be a wise strategy to embrace over the next five years.

The best stocks to buy in 2025 could very well prove their merit in the coming years. However, we have also highlighted the possible risks involved. This is why (much like any investment), traders should always adopt a rather circumspect approach to mitigate scenarios such as sudden price swings, or bearish reversal trends. Let us now examine some tips that can be employed to offset these understandable concerns.

Diversification is a term that exists throughout the investment community, and it is just as relevant when discussing the best AI stocks to buy now, and well into the future. One of the advantages that has come to define the artificial intelligence industry is its decidedly broad scope. As opposed to a discreet asset class such as semiconductor chips, a wide range of categories can be selected. This will enable online trading brokers to provide several investment options across sectors such as:

Note that investments can also be classified according to specific industries. Healthcare, transportation, retail, manufacturing, and social media all represent viable examples of what the near future may have in store.

We now come to yet another important topic. Is it better to invest in small-cap AI stocks, or do mega-cap ventures promise the best ROI? There is no simple way to address this logical concern. However, a brief example of general market fundamentals can shed some light on the issue.

It is important to remember that any mega-cap investment will often provide a greater degree of longitudinal stability. This is due to the notion of diversification mentioned in the previous section. Simply stated, these firms are less likely to be severely impacted by adverse market conditions. The only potential downside here is that long-term holds may be required before turning a significant profit. However, this concern may be offset by investments that also provide regular dividends.

What about small-cap opportunities? Some have touted these as the best AI stocks to buy in 2025 due to the potential to realise substantial returns. This is the very same risk-versus-reward principle that traders have always grappled with. While profits could very well exceed those associated with mega-cap positions, losses might also exceed forecasts. Similar to a small boat within a storm, it is much more difficult for any small-cap stock to negotiate rough seas without foundering.

This is why investors should embrace a circumspect approach, and seek to create a balanced portfolio. A mixture of small-cap and larger AI stocks is one of the most effective ways to supersede such volatility. Furthermore, diversifying into other sectors (such as commodities, blue-chip holdings, and government bonds) will provide yet another level of stability. This can be used to hedge against any potential losses that small-cap AI investments may incur from time to time.

Are there any other methods that can limit the risks attributed to the AI sector? One practical strategy involves ensuring that the asset/investment is fully aligned with existing governmental regulations. Ethical concerns such as algorithmic transparency, and data privacy are just as relevant.

Another recommendation not only involves identifying the best AI stocks to buy now, but how they are expected to perform well into the future. This is when both technical and fundamental analyses will come into play. The only possible issue here is that as AI represents a relatively new sector, historical data will often be lacking. Therefore, forward-thinking investment strategies (such as the analysis of long-term moving averages) generally represent the most effective approaches.

A final suggestion is one which is just as applicable for any type of investment. Anyone who is relatively unfamiliar with this sector should begin by opening a trading demo account with a trusted platform. This is the best way to become accustomed to the technical aspects of the AI sector, and to learn about indicators such as candlestick charts, MACD graphs, and Fibonacci retracement levels. Activating a demonstration account will ensure that real-world funds are not placed at risk when the initial stages.

Discover the latest updates, insights, and trading opportunities with Eurotrader — click here to explore further.

Some readers may be curious to learn if exchange-traded funds (ETFs) associated with the AI sector can serve to supplement the best AI stocks to invest in in 2025. AI ETFs offer several possible advantages, including:

However, note that thinly traded ETFs may suffer from a lack of liquidity; making it difficult to exit a position. This should be taken into account when analysing the fund in question. The option to trade share CFDs within the AI sector could also represent an interesting alternative to consider.

Many experts seem to feel that NVIDIA is one of the best stocks to buy in 2025. Not only has this firm developed a solid reputation since its launch as far back as 1993, but it represents an excellent long-term hold. You can always refer back to the summary outlined earlier to appreciate the finer points.

While it is impossible to predict what the remainder of 2025 has in store with absolute certainty, several stocks have already caught the eye of seasoned investors. These include NVIDIA, Taiwan Semiconductor Manufacturing (TSM), ASML (a top manufacturer of microchips used throughout the artificial intelligence sector), and Google Alphabet. Additional information can be found by researching these firms online, and plenty of details are available.

While this term may appear to be somewhat superfluous, it has already made its way across various investment circles. Some traders feel that the company SoundHound is one of the best AI stocks of 2025. As SoundHound specialises in voice-related artificial intelligence algorithms, it could soon offer several tangible real-world applications. The fact that it is amenably priced at the moment represents a potentially lucrative entry-level opportunity.

Yet another attractive feature about artificial intelligence is that many assets may still be underpriced. A handful of stocks include SoundHound AI, Lantronix, FiscalNote Holdings, Rekor Systems, and AudioEye.

What can we take away from the information presented above? Here are some of the main reasons why artificial intelligence could represent the next major paradigm shift throughout the financial community:

Another important reason for this momentum is that artificial intelligence is already being applied to solve real-world problems. In other words, it is no longer mere theory. From healthcare and manufacturing to everyday applications such as ChatGPT, the public is quickly becoming aware of the potential. This should lead to significant upside advantages from a medium- to long-term perspective.

However, AI investing can also represent a risky proposition. Market volatility, future regulatory concerns, and poorly managed small-cap opportunities may lead to significant losses. The main question involves one’s appetite for risk, as well as any long-term goals.

Even after considering the possible downsides, there is little doubt that artificial intelligence is set to enjoy an unprecedented boom in the coming years. Astute traders who choose to become involved with the best AI stocks of 2025 could very well place themselves on the path to long-term success.

Would you like to learn more about AI investing? Are you instead curious about other subjects such as how to trade share CFDs of another asset class? If so, please take a moment to reach out to Eurotrader. From the United Kingdom and Canada to South Africa, Australia, and beyond, we have the needs of our clients covered.

Start your trading journey with Eurotrader today — register and trade with confidence.