A cyclical stock is a type of stock that moves in line with the overall state of the economy. These stocks are highly sensitive to changes in economic conditions, such as fluctuations in consumer spending, interest rates, and business cycles. As a result, cyclical stocks often experience stronger growth during economic expansions and sharper declines during recessions.

Moreover, cyclical stocks often exhibit a correlation with specific sectors or industries. For example, automotive, retail, and travel companies are usually more cyclical than defensive sectors like healthcare or utilities. Understanding the industry dynamics and market trends is important when analyzing cyclical stocks.

For beginners, learning How to Identify Cyclical Stocks is key to understanding which industries move with economic trends and which remain stable during downturns.

Investors interested in cyclical stocks should take into account the overall state of the economy and the specific industry conditions. They should carefully evaluate key economic indicators, such as GDP growth, employment rates, and consumer sentiment, to determine the potential performance of cyclical stocks.

It’s also essential to consider external factors, such as fiscal policy, global events, or technological change, which can amplify or weaken economic cycles. Using data tools provided by a reliable indices trading app can help track sector performance and market momentum across global economies.

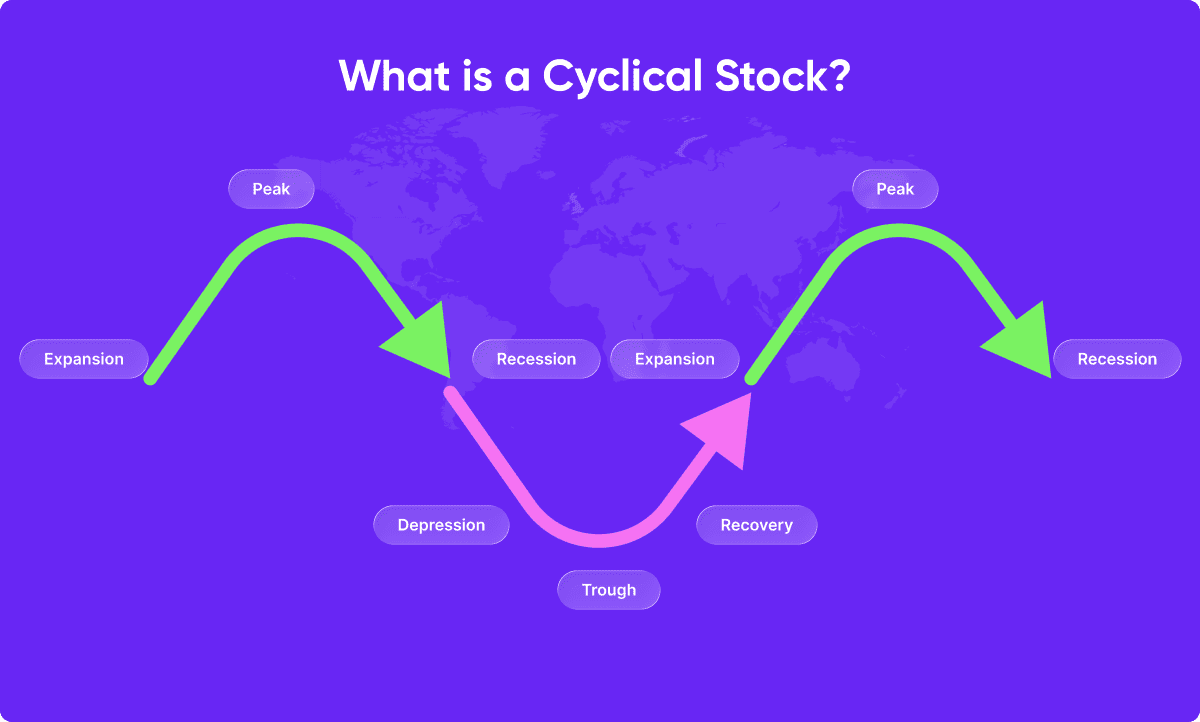

Cyclical stocks rise and fall with economic trends:

Investors working with a trusted stock trading broker can use cyclical patterns to time entries and exits more effectively. Understanding the economic cycle and analysing sector trends can help investors decide when to buy or reduce exposure to cyclical stocks.

You can also study How to Invest During Market Cycles to build strategies that balance cyclical and defensive assets for stability and growth.

Let’s take a look at some cyclical stocks to help you get a better understanding.

As a manufacturer of construction and mining equipment, Caterpillar’s stock is influenced by economic cycles. When construction and infrastructure projects are booming, the demand for Caterpillar’s products increases, leading to positive stock performance.

Airlines like Delta are considered cyclical stocks because their profitability is tied to economic conditions. During periods of economic growth, people tend to travel more, boosting airline revenues and positively impacting Delta’s stock.

Home Depot is a cyclical stock because it is heavily influenced by the housing market. When the housing market is strong and people are buying homes, there is a higher demand for home improvement products, benefiting Home Depot’s stock.

Other common cyclical examples include car manufacturers, luxury retailers, and hospitality companies. Traders may also access these sectors through CFDs using a regulated CFD trading broker, allowing them to speculate on market movements without directly owning the shares.

Check out our resources for more information and much more on the basics of trading!

Typical industries considered cyclical include:

Defensive sectors such as Utilities or Healthcare, by contrast, are considered non-cyclical and remain stable even during downturns.