CFD Indices Trading

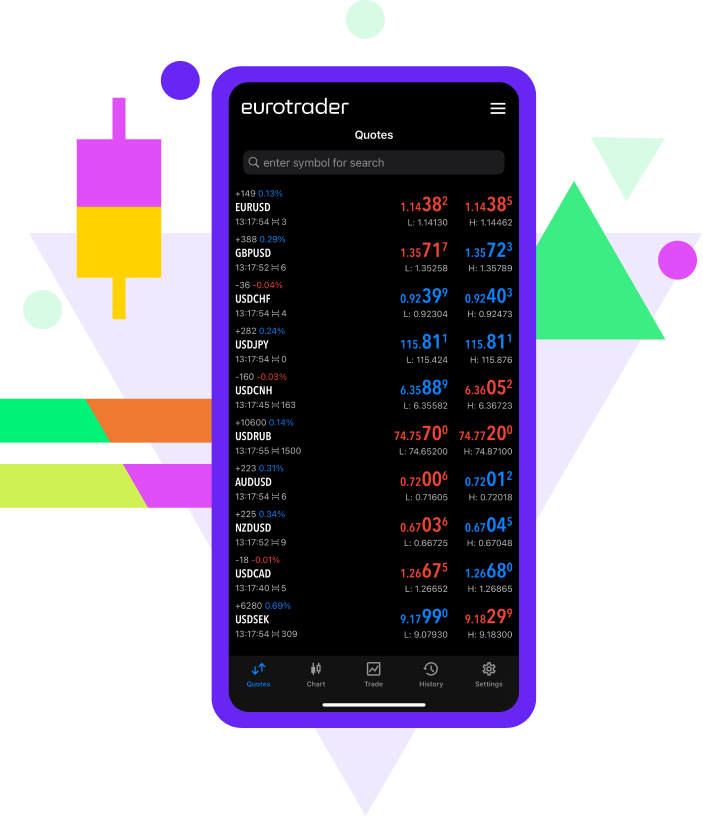

Dive into trading Indices CFDs with Eurotrader! Whether you’re bullish or bearish, speculate on the world’s leading stock indices such as the Dow, FTSE 100, S&P 500, and DAX 30.

There are a few other currencies that deserve to be mentioned. Informally known as the ‘commodity pairs’, the AUD/USD or ‘Aussie’, USD/CAD and NZD/USD are all frequently traded currency pairs. Unsurprisingly, this group of currencies derives its nickname from the fact that they come from countries that possess large quantities of natural resources.

What are some Popular Indices?

CFDs provide opportunities to trade the world’s most popular indices. Eurotrader offers CFDs on a wide range of indices from all over the globe ranging from iconic indices like the NASDAQ, Dow Jones and FTSE 100 to more particular indices such as the ES35 and UK100.

Take a look on this page to discover all the indices you can trade with us. You can organise the entirety of our indices instrument table by the most traded, most volatile, top risers and top fallers. Our interactive table displays prices in real time as well as shows the past two days percentage change. Follow live indices prices and charts here.

Dividends & Positions on Indices

Dividends will be accrued to clients who hold positions on indices.

What is a dividend?

The distribution of a section of a company’s earnings to its shareholders is known as its dividends. Dividends are a portion of earnings chosen by the company’s board of directors and can be issued in the form of shares of stock, cash payment or property. When a company makes a profit it can reinvest this money back into the company and/or distribute the profits to its shareholders.

If a company decides to pay its shareholders dividends, a fixed amount per share is designated and shareholders will receive this amount at a specific date. The ex-dividend date determines when trading in the underlying stock no longer includes an entitlement to the upcoming dividend payment and therefore on the ex-dividend date the value of the underlying share will decrease by the approximate dividend value. Anyone already holding a position in the underlying stock prior to and going into the ex-dividend date will be entitled to receive, or required to pay, the dividend depending on whether they are long or short. Anyone opening a position on the ex-dividend date will not be entitled to, or required to pay, the dividend.

An index typically reflects the weighted average share price of several underlying stocks trading on the same exchange, therefore if one of these stocks declares a dividend payment then the underlying share price will decrease by the dividend value and the index will also decrease by the equivalent weighted average value of the same dividend on the ex-dividend date. Clients that hold positions on indices will receive or pay the equivalent weighted average value of the same dividend on the ex-dividend date.

Tools for Traders

All in One Calculator

Our all in one calculator helps you calculate any parameter relating to your trading whether that is the pip value in your base currency, the Swap cost, and the margin required to open a trade. It can even assist you in calculating where to place your take profit or stop loss depending on how much you want to risk.

Educational Center

Our educational center is there to assist you in better understanding the CFD market and together with our bespoke economic calendar comprise an invaluable tool for every trader.

Trading Central

We have partnered with Trading Central that brings useful insight to every trader. With a comprehensive daily newsletter, a top of the class economic calendar and a connectivity to MT4 and MT5 it will empower your trading skills and optimize your trading strategies through a combination of actionable technical analysis, educational guidance and customizable alerts.

Choose your platform

MT4

MetaTrader 4 transforms trading with its intuitive interface and advanced analysis tools, empowering seamless strategy execution. With its mobile applications, traders can now trade anywhere, anytime, ensuring flexibility and accessibility on the go.

MT5

Experience the future of trading with MetaTrader 5, where enhanced features like additional timeframes and advanced market depth functionality ensure every trade is precise and efficient. With its cutting-edge technology, MT5 sets a new standard for trading excellence

Why Trade with us?

Competitive Spreads

- Experience tighter spreads and maximize your trading potential.

- Our commitment to transparency ensures you get the best rates.

Enhanced Liquidity Pool

- Access a deeper market with superior liquidity for smoother trades.

- We connect you with major banks and financial institutions, ensuring continuous trading flow.

No Dealing Desk Intervention

- Trade with confidence, knowing there’s zero interference from our side.

- A range of liquidity providers guarantees a fair and transparent trading environment.

Fast Execution

- Never miss a trade with our lightning-fast execution speeds.

- Our advanced technology ensures your orders are processed in milliseconds.

Flexible Trading Conditions

- Tailor your trading strategies with our adaptable platform settings.

- Whether you’re a beginner or a pro, our platform caters to every trader’s needs.