Introduction:

Starting out in trading can feel overwhelming looking at the array of technical indicators available.

However, not all indicators are created equal.

Here are 7 of the most useful indicators that every beginner trader should know, along with tips on how to best apply them.

#1: Moving Averages (MA)

Moving averages smooth out price action and help identify bias and potential support/resistance levels.

Use the 50 & 200 MA to determine overall trends on higher time frames.

On lower time frames, shorter MAs (5 & 20) provide dynamic levels.

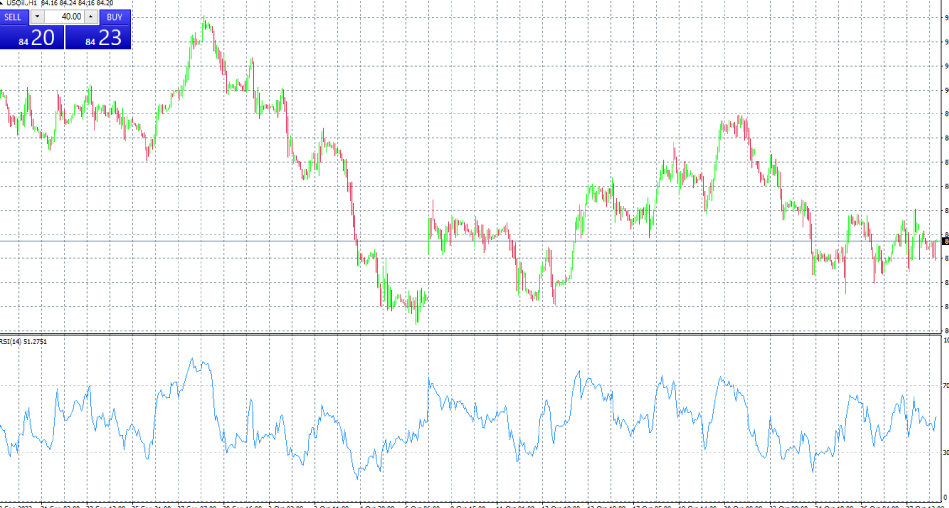

#2: Relative Strength Index (RSI)

RSI measures the speed and magnitude of recent price movements to identify oversold and overbought conditions.

An RSI below 30 signals an oversold bounce is likely, while over 70 indicates a market topping.

#3: MACD (Moving Average Convergence Divergence)

The MACD crossover system reveals shifting momentum through the interaction of its two moving averages.

Trade signals occur when the shorter MA crosses above or below the longer MA.

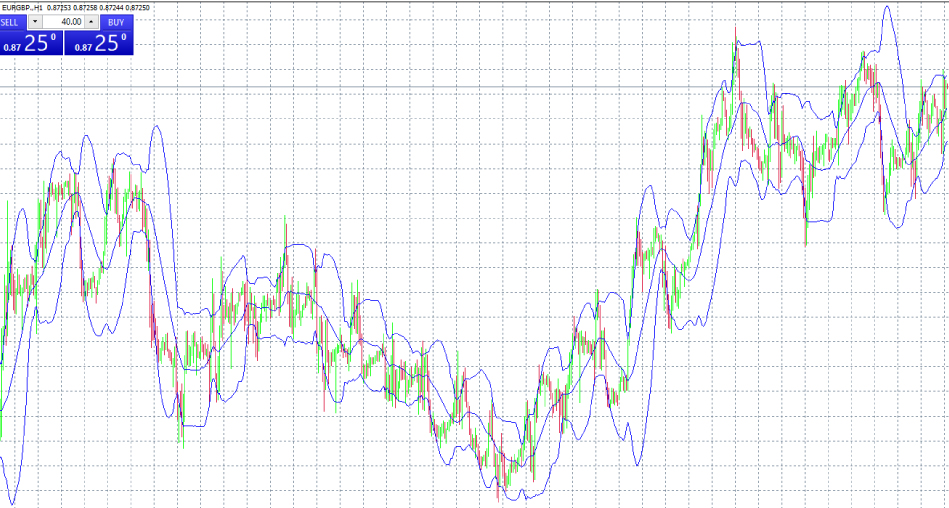

#4: Bollinger Bands

Bollinger Bands plot volatility-based envelopes above and below a simple moving average.

Applying Bollinger Bands shows whether prices are relatively high or low on a normalized basis.

#5: Stochastic Oscillator

This momentum indicator identifies oversold and overbought levels via a scale from 0 to 100. S

ignal line crossovers and extremes can reveal entry and exit points.

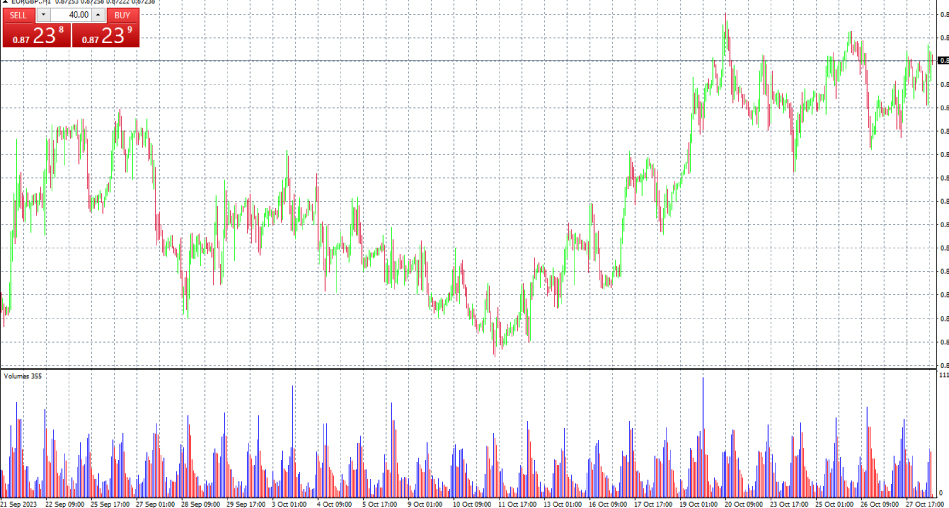

#6: Volume

Analyzing volume provides confirmation of major price moves and breakouts.

Increasing volume points to a high conviction move, while decreasing volume suggests fading momentum.

#7: Support and Resistance

Horizontal support and resistance levels form important potential reaction points where orders cluster.

These derive from previous peaks and lows and signal areas for entries or stop losses.

Conclusion:

Mastering these seven foundational technical indicators will provide beginner traders with a versatile toolkit to find high-probability setups across various markets and timeframes.

Start applying these to develop your analytical skills.