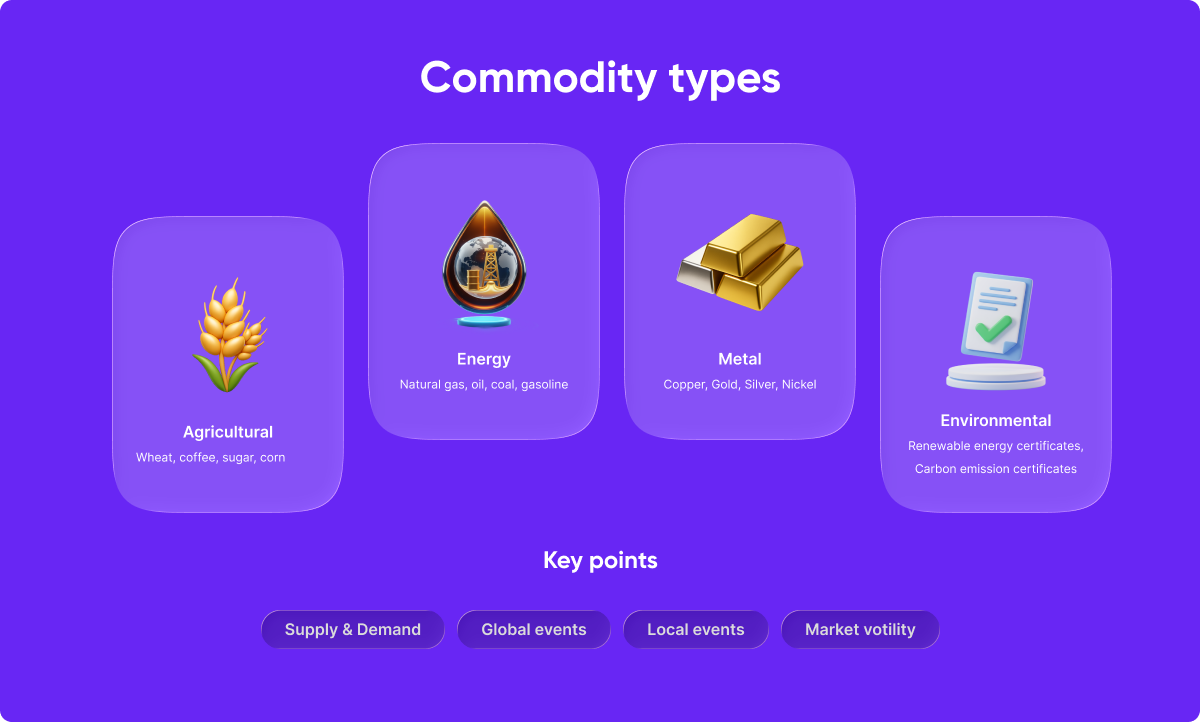

A good starting point is getting familiar with the main commodity categories. Each one tends to follow its own rhythm. Energies like crude oil respond heavily to inventory numbers, production updates, and geopolitical pressure. Metals such as gold and silver often shift when interest rate expectations change or when markets become nervous. Agricultural products are more tied to weather cycles, crop forecasts, or seasonal demand.

If you have not looked into the fundamentals yet, understanding what is commodity trading gives you a helpful base. It also puts some context around why these markets sometimes move in sharp bursts rather than slowly trending like other asset classes.

Liquidity also plays a part. Some products are busy all day, while others only become active around certain economic releases. That variation is normal, so it is worth keeping an eye on when your chosen markets tend to move.

Your broker affects almost every part of the process, from the prices you see to how easily you can execute your plan. A solid environment helps you trade without unnecessary friction.

Most traders look for a few things:

A strong commodity trading broker gives you a cleaner and more predictable foundation to build on.

Once the account is open, the next step is simply making the platform usable. Traders often spend a few minutes setting up charts, watchlists, alerts, and templates so everything feels tidy and functional. It might not sound important, but when markets start moving quickly, having a familiar layout saves time.

You can decide which funding method works best for you. Some prefer instant transfers, others prefer more traditional routes. As long as you understand the process, deposits and withdrawals become straightforward.

Small details help too. Setting a default order size, for example, keeps you from accidentally placing a position far larger than intended.

Most new traders begin by learning how different commodities behave, opening an account with a commodity trading broker, and practising with smaller trades until they understand price movement and margin requirements.

There is no fixed amount. Many traders begin with a modest balance and gradually increase their exposure as they become more comfortable with volatility.

Highly liquid markets like gold, crude oil, and natural gas are common choices because they offer clear movement and regular analysis.

Volatility, leverage, supply disruptions, and reaction to news all create risk. Using stops and careful position sizing helps reduce these effects.

Leverage allows you to control a larger trade with a smaller deposit. It increases both potential profit and potential loss, so keeping an eye on margin is essential.