So, what is arbitrage? Arbitrage is about reacting faster than the market adjusts. If EUR/USD shows one price on one feed and a slightly different price elsewhere, that is a gap. Traders who specialise in arbitrage watch for these small misalignments. They do not rely on predictions or chart patterns. They rely on speed.

If you are already familiar with forex trading, you might know that currency prices move around the clock. Because of this constant movement, temporary differences can appear between two brokers or two liquidity sources. These moments do not last long. The market typically corrects itself quickly.

There are a few styles traders come across when exploring arbitrage. They share the same core logic but work differently in practice.

Most retail traders focus on broker arbitrage or simple currency discrepancies because they are easier to track manually.

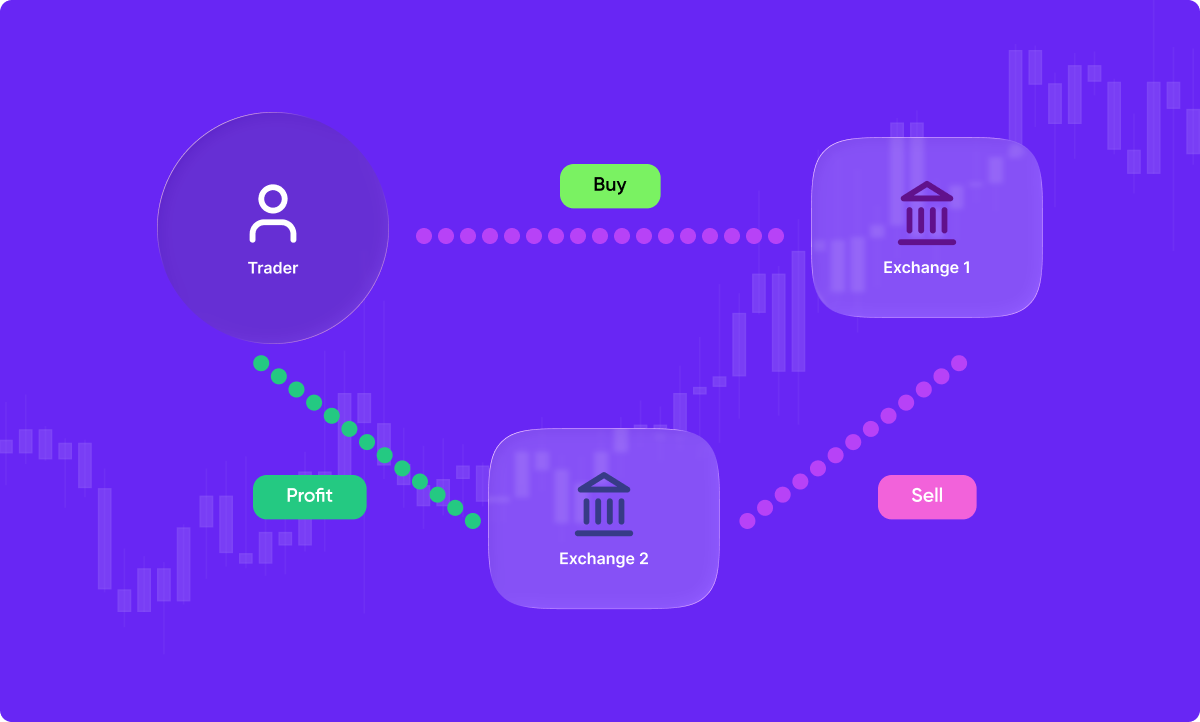

A typical arbitrage sequence is straightforward:

It sounds clean, but even small delays can break the sequence. The price might equalise before the trades fill. A spread may widen unexpectedly. One order might execute while the other slips.

This is why arbitrage relies on a good environment. A slow platform makes the entire idea fall apart.

If you want to practise the mechanics without pressure, a demo account is often the safest place to do it.

You look for price differences between two markets or two brokers, then buy at the lower price and sell at the higher one at the same time. The gap between the two prices is the potential profit.

No, arbitrage itself is not illegal. It is simply taking advantage of temporary price differences. The key is trading within regulated environments and following standard trading rules.

It is an informal timing concept that some traders reference. It suggests waiting a few minutes before entering a trade, avoiding the earliest volatility, and letting positions develop for several minutes if momentum is strong.

It can be, but the opportunities are usually small and disappear quickly. Execution quality and spreads play a major role in whether it works in practice.

Yes. UK traders can use arbitrage strategies through regulated brokers, as long as they follow normal trading guidelines.